Schedule E Guide for Rental Property Taxes (2021 Update)

If you are like most, filling out tax forms when you just started investing in real estate can be very stressful. Not to fear, we have compiled everything you will need to know as a rental property owner!

Do I need to file a Schedule-E for my rental property?

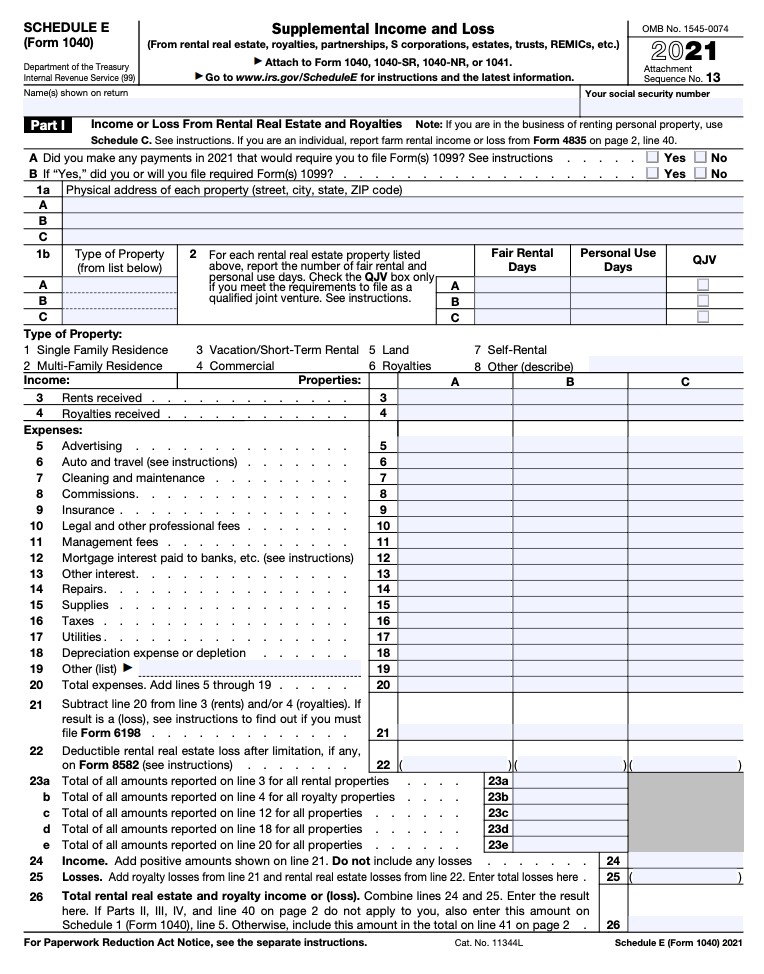

Have you earned rental income on a home you own in the past year? If so, you will need to file a Schedule E form with your 1040. As a real estate owner, the IRS will only require you to file a Schedule C instead of a Schedule E if managing several rental properties is your main business. A Schedule E form applies to not only rental property owners, but also to those that are simply renting out a room in their own house.

2021 Tax Year Updates

- Refundable credits if you're self-employed and impacted by the coronavirus (Form 7202)

- Standard mileage rate has decreased to $0.56 per mile

- Business meals are 100% deductible between December 31, 2020 to January 1, 2023 if provided by a restaurant

- Safe harbor if you received a loan from the Paycheck Protection Program (PPP) and meet certain criteria

- Tax credits for qualified sick and family leave wages for leave taken before April 1, 2021

What do each of the Schedule E categories mean?

Part I

Depending on where you live this answer will vary in complexity. For example, California is experimenting with a new ABC test that has made it harder to classify workers as contractors, also known as 1099 employees. Other states including Connecticut, Illinois, Massachusetts, Maryland, Minnesota, New Jersey, New Mexico, New York, Oregon, Pennsylvania, Virginia and Washington have backed this cause. If a worker fits all three of the classifications below then they are allowed to be treated as an Independent Contractor:

- The worker is free from the control and direction of the hirer in connection with performing the work.

- The worker performs work outside of the usual course of the hiring entity’s business.

- The worker is usually engaged in an independently established trade, occupation or business of the same nature as the work performed for the hiring entity.

Expenses

This Schedule E allows you to deduct several amounts paid for rental property expenses. These vary from things such as advertising to depreciation. It is important to note that you are able to deduct for repairs and maintenance but you cannot deduct the cost of improvements. Examples of maintenance include: fixing a broken lock or painting a room, whereas improvements are shown in the case of adding or replacing an entire HVAC system.

Depreciation Expense or Depletion

We know that this section is especially confusing, so we hope to make it easy. If you are not certain of the fair market value of the land and homes that you own, you can divide the cost between them based on their assessed values for real estate tax purposes. Don’t forget that land is never depreciable, so ensure that you are using the correct figure that excludes the value of the land!

Losses

Tough year to be an owner? If you have experienced a loss in the past year, there are limits to the amount of losses that you can report on this form. You can only claim a loss as big as the amount that you can lose in the activity. Your maximum loss cannot include things such as nonrecourse loans used to finance the activity.

Auto and Travel

There is a constant debate around whether it is worth one’s effort to document actual car expenses compared to using the standard mileage rate. The standard mileage rate is around 56 cents a mile in connection with rental activities. Several cost/benefit analyses have proven that it isn’t worth your time to keep track of one’s actual car expenses.

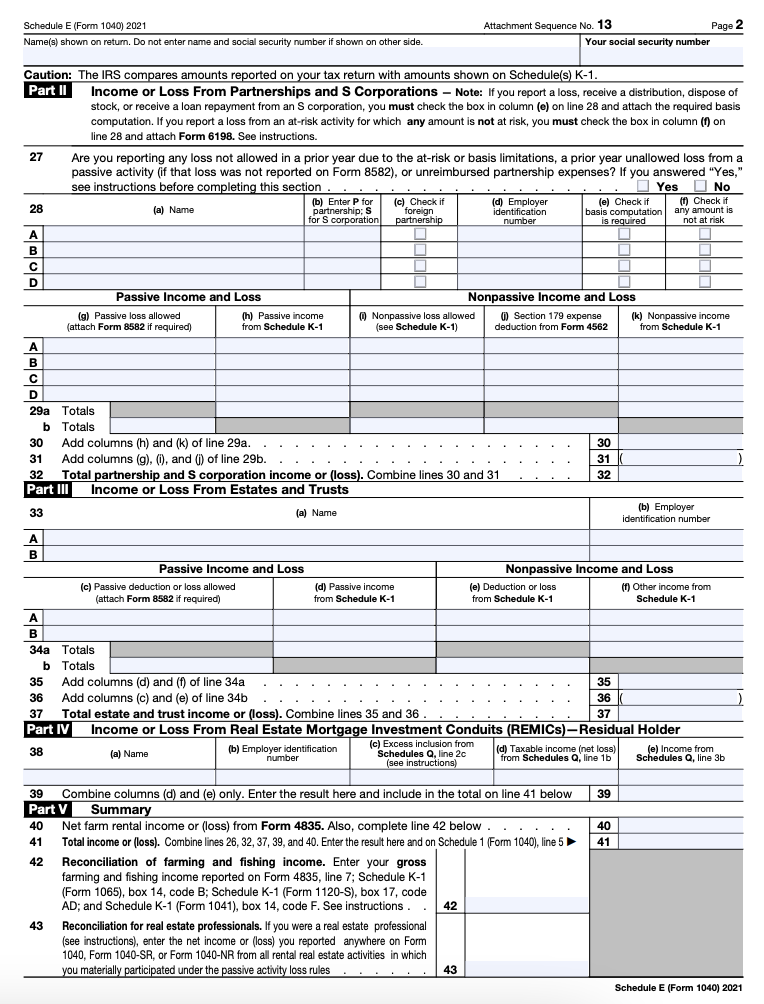

Part II

Within this Schedule E, you will be asked to identify losses in terms of passive vs. nonpassive activities. As a rule of thumb, income and losses related to rental properties are considered passive activities. However, if you are a real estate professional then you will not be able to deduct several of these losses due to your nonpassive relationship.

Are there any deductions that apply to me?

We want to make sure that you take advantage of the several deductions on this form.

Interestingly, this Schedule E form can be applied to those that are owners in partnerships or S-Corporations as well. The recent Tax Cuts and Jobs Act established a new deduction that can equal up to 20% of your income if your entity is established as a sole proprietorship, LLC, or a partnership. Wouldn’t that be great! Other typical deductions on this form include a $15,000 maximum deduction for costs paid to make your property usable by people with disabilities or the elderly.

Anything else I should know?

This Schedule E is ultimately shown on your IRS form 1040, under net income or loss from rental properties. Be certain that you have good records that help explain each line item on the Schedule E. If you cannot reproduce these items, you may be forced to pay additional taxes and penalties.

Get the Latest in Real Estate & Property Management!

I consent to receiving news, emails, and related marketing communications. I have read and agree with the privacy policy.