New Tax Bill's Impact on Landlords and Real Estate Investors

President Donald Trump signed the GOP tax bill into law on December 22, 2017. News has speculated how the new legislation impacts rental properties and investments in real estate.

Brandon Hall, the founder and CEO at The Real Estate CPA, breaks down the actual details for us. This article is for real estate investors, landlords, and property managers on the new tax bill.

Impact on rentals and real estate

Rental Income: No Change to Self-Employment Tax Rules

This earlier clause from the House bill was considered a mistake. Rental income is not subject to self-employment taxes. Landlords are not required to pay an additional 15.3 percent in taxes on their net rental income.

Pass-Through Deduction: Added a New Freebie Deduction

The pass-through deduction will truly benefit landlords. It is a calculation after AGI (adjusted gross income) and is given to sole proprietors, LLCs, and S-Corps generating qualified business income. For partners in a business, the deduction is based on your specific ownership.

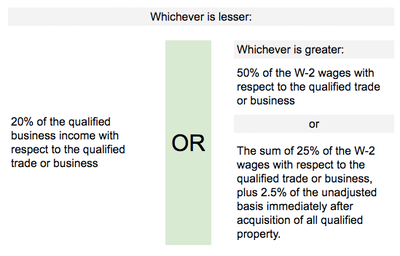

Brandon has provided the exact calculation below, where you can run your own scenario. In general, rental properties with net income after amortization and depreciation will receive a 20 percent deduction on net income or a 2.5 percent deduction on your property’s unadjusted basis (which does not include the value of the land). The 20 percent deduction appears to be on the total rental income for your business portfolio, but it is applied on a business-by-business basis.

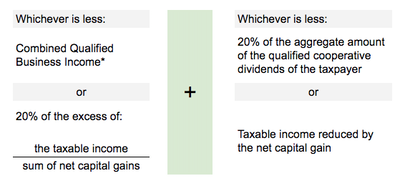

The deduction is calculated as follows:

*Combined qualified business income is calculated as follows:

Note that this deduction does not apply to service businesses, unless the taxpayers who own the service businesses have total taxable income less than $157,500 if single or $315,000 if married filing joint. If this is the case, then they receive a 20% deduction on combined qualified business income. A service business is defined as “any trade or business where the principal asset is the reputation or skill,” excluding engineers and architects.

Domestic Production Activity Deduction (DPAD): Eliminated

The DPAD was a deduction based on wages paid through the ordinary course of business. Flippers, developers, and builders cannot take advantage of the DPAD any longer. However, you can use the new pass-through deduction above to counter the elimination of DPAD.

Itemized Deductions: No Change on Rentals but Change for Primary and Secondary Residences

Rental property owners can still deduct business expenses from the rental properties, and there is no change here.

Primary and secondary residences have the largest impact. Beginning December 15, 2017, owners can deduct mortgage interest on the initial $750,000 of a newly acquired debt. But unless the proceeds are used to purchase or improve rental properties, home equity debt cannot be deducted. A property owner cannot deduct the interest on home equity debt, refinancing, or HELOCs (home equity line of credit). If the residence is in a higher income state, the limit is most likely to be exceeded as State and local income and property tax deductions are limited to $10,000 annually.

While an owner can still allocate tax preparation fees to Schedule C and E, tax preparation fees and unreimbursed employee expenses cannot be claimed as miscellaneous itemized deductions

Property Depreciation: No Change

While there was a proposal to reduce the useful life of residential and commercial property to 25 years, there is no change to property depreciation in this bill. The useful life of residential rentals and commercial property is 27.5 and 39 years respectfully.

Bonus Depreciation: Change for Assets with Less than 20 Years

The useful life of a rental property is listed at 27.5 years. Beginning September 29. 2017, assets with a useful life of less than 20 years will qualify to be 100% expensed through bonus depreciation. Examples within a property include:

- Appliances

- Carpet

- Computers and software

- Equipment and tools

- Land improvements (landscaping, driveways)

While you cannot 100% expense a rental property, due to a higher useful life, you can expense these assets within and on the property.

What is Bonus Depreciation? Since this is bonus depreciation, you pay depreciation recapture tax when you sell the asset. In other words, you have to pay it back someday, even if you are not paying the taxes on it today.

Rehabilitation Tax Credit: Eliminated the 10 Percent Credit

For real estate investors who are developing older buildings, the 10 percent credit for pre-1936 buildings has been eliminated. It is only available for certified historic structures, where a 20 percent credit is applied.

1031 Exchanges: Changed to Only Allow Real Property

The 1031 exchange allows real estate investors to exchange a property for a “like-kind” property without paying taxes immediately on the gain. The tax is deferred until the last “like-kind” property is sold.

The good news is that real estate investors you can still leverage the 1031 exchanges. The bad news is that it can only be applied to real property. For those who perform a cost segregation study, where personal property components are depreciated over a shorter time, it is unclear whether or not the personal property components within the study are still eligible to be included in the 1031 exchange.

Section 179: Doubled in Amount and Available to Commercial Owners

Section 179 allows the write off the cost of certain property. The total amount that can be expensed has doubled, from $500 thousand to $1 million. For commercial and some short-term rental owners, their non-residential properties can take advantage of Section 179 for fire systems, security systems, roofs, and HVACs. For NNN property and AirBnB, many of these will qualify for immediate expensing of large improvements.

Section 121 Exclusion: No Change

Section 121 allows an owner to exclude a certain amount on the capital gains on the sale of a primary residence. This amount is $250,000 for single taxpayers and $500,000 for married filing jointly, with the provision that the owner must live in the residence for the past two of five years. The length was proposed to be changed to the past five of eight years, but this proposal did not pass.

Lifetime Gift Exclusion: Doubles

The lifetime gift exclusion is the amount of wealth that you can pass onto someone else, tax-free. The change benefits those with large estates, as the lifetime gift exclusion has doubled from $5 million to $10 million per person.

It is important to note that this is the lifetime gift exclusion. The annual gift limit remains at $14,000, where any amount over it must be report a gift tax return of any amount of that, which is reduced from the lifetime exclusion.

Other Important Tax Plan Changes

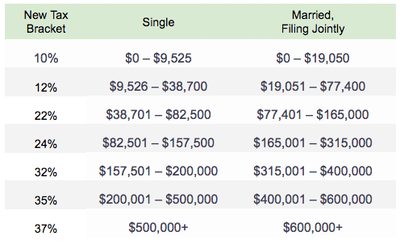

Tax Brackets: Revised

Here are the new income tax brackets:

Standard Deduction: Nearly Doubles but Personal Exemptions are Eliminated

Single and married taxpayers can claim $12,000 and $24,000, respectively. This is nearly double the existing standard deduction. These changes will make it where the majority of taxpayers will not opt to itemize their deductions.

Historically, taxpayers could take a personal exemption deduction of $4,050 per person on the tax return. This personal exemption has been eliminated and will be a disadvantage to those with multiple dependents.

529 Plans: Expanded for Education

529 plans can now be used to pay for private, public, and religious elementary and secondary schools. In addition, you can use these plans towards qualified education expenses.

Alternative Minimum Tax (AMT): Exemption Amounts Increased

While there was discussion of eliminating the AMT, it did not go through. Exemption amounts increased to $109,400 for married filing jointly and $70,300 for all other taxpayers. The phaseout thresholds, indexed for inflation, increased to $1,000,000 for married taxpayers filing a joint return, and $500,000 for other taxpayers.

Obamacare: Eliminated Penalty for Non-enrollment

Obamacare had a penalty for those who opted to not enroll in healthcare. Effective in 2019, individuals can select to not enroll in health insurance. Healthcare premiums are expected to increase as healthier folks will be less likely to enroll in health insurance.

C-Corporations: Reduced Tax Rate

C-Corporations will have a tax rate of 21 percent, providing over $1 Trillion in money back to large companies. While most real estate investors have their properties in LLCs, they may be affected, depending on how the corporations choose to use their savings.

For most of the tax bill changes, they are effective from January 1, 2018 to 2025.

For the length of the bill, nearly 1,000 pages of text, the implementation process was incredibly fast. It took seven weeks from development to ink on the paper for a $1.456 trillion tax bill. Compare this to the Tax Reform Act of 1986, which took nearly two years. The speed that this bill went through legislative leaves questions on whether there is opportunity for loopholes. The extent to which loopholes could exist will not be known until someone analyzes and reviews corner cases in more detail.

Photo Credit: Helloquence

Get the Latest in Real Estate & Property Management!

I consent to receiving news, emails, and related marketing communications. I have read and agree with the privacy policy.