What landlords need to know about the Federal Eviction Moratorium

As the COVID-19 pandemic continues, a blanket ban on residential evictions has been extended through to the end of 2020. There remains a lot to be clarified still on the extent and enforceability of this ban, depending where you live. We have provided below an overview and key things landlords should know while navigating the complexities of this crisis.

Disclosure: Below is a compilation of information relevant to landlords and property managers of residential properties relating to the Federal eviction moratorium order issued by the Centers for Disease Control and Prevention, CDC, on September 1, 2020. By no means does the information below act in place of legal advice.

Can the Government take away private property rights?

The short answer based on what we know is, yes, unless it can be proven otherwise in the courtroom. Merriam-Webster Dictionary defines a moratorium as a legally authorized period of delay in the performance of a legal obligation or the payment of a debt.

According to data from the the Centers for Disease Control and Prevention, CDC:

- The Coronavirus Aid, Relief, and Economic Security (CARES) moratorium provided relief to a material portion of the nation’s roughly 43 million renters.

- Approximately 12.3 million rental units have federally backed financing, representing 28% of renters.

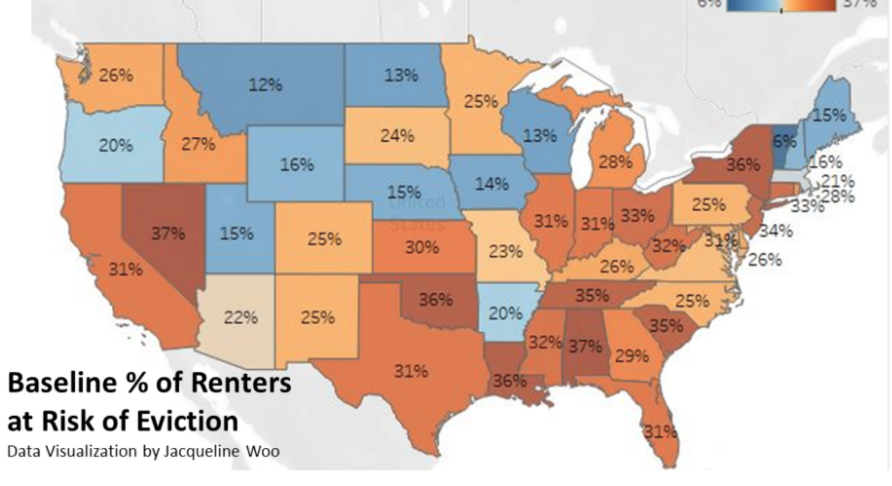

- Without State and local protections, as many as 30-40 million people in America could be at risk of eviction.

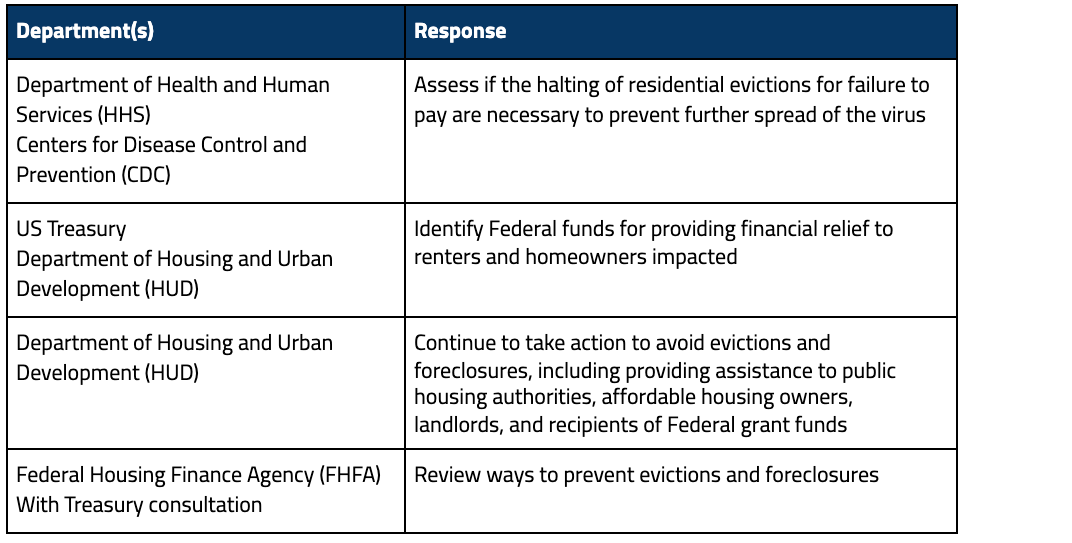

With the expiration of the CARES Act on July 24, the Whitehouse issued an executive order on August 8 with the following four directives:

The Whitehouse executive order led to the CDC’s emergency order response issued on Sept. 1 prohibiting evictions until after December 31, 2020. This is subject to be extended, modified, or rescinded based on how the situation unfolds. This is also a minimum requirement and some localities may have tighter restrictions.

This order is meant to avoid mass evictions and contain the spread of the coronavirus. Qualifying tenants who cannot meet their rent obligations due to coronavirus impacts must sign a declaration form administered by the CDC and provide it to their landlord in order to avoid eviction.

The objectives of this recent moratorium announcement include:

1. Housing stability to mitigate spread within congregate or shared living settings, including homelessness. It is difficult to practice appropriate physical distancing and other infection control measures if people are forced to move, especially if it is into close quarters in new shared housing or congregate settings.

2. Mitigate spread across borders. More than half a million people move across state borders every year and mass evictions would likely increase interstate spread.

3. Support response efforts at Federal, State, and local levels.

Rent is not canceled

Some of the news articles out there will have you believe that rent is canceled for the rest of the year but that's not actually the case. Renters are still obligated under their lease agreement to pay their rent. There are however differing interpretations and court challenges on whether or not eviction cases can proceed at this time, and much of this depends on where you live.

Here’s what you need to know:

1. Applies to residential tenants with genuine COVID-related hardships

Rent is not canceled. This only applies to residential tenants in residential properties unable to pay rent due to COVID-19.

2. Tenants must declare inability to pay rent

Every adult in the household on the lease must provide a written declaration that declares the following (this is legally enforceable under penalty of perjury):**

- Used best efforts to obtain all available government assistance for rent/housing

- Earn no more than $99,000 annually for individuals, or $198,000 for joint tax returns

- Unable to pay full rent due to substantial loss of income, hours/wages, had a lay-off, or extraordinary out-of-pocket medical expenses

- Using best efforts to make as large as possible and timely partial payments (as circumstances permit)

- An eviction would likely render the individual homeless or force them to move into a new congregate or shared living setting because of no other available housing options

Resource: The CDC declaration form is available for download here.

3. Non-COVID related evictions can still move forward

Tenants can still be evicted if for reasons other than not paying rent or making a housing payment.

Eviction exemptions include:

- Criminal activity

- The renter threatens the health or safety of other residents

- Property damage or renter poses a significant and immediate risk of property damage

- Violations of building codes, health ordinances, or similar health and safety regulations

- Lease violations other than non-payment of rent

4. Not all tenants are eligible

This only applies to individuals who were financially eligible for a stimulus check earlier this year.

5. Rent is still due

Tenants are still responsible for missed rent. Fees, penalties and interest as per the lease agreement may also be charged and collected.

Know your risk and assess your cash runway

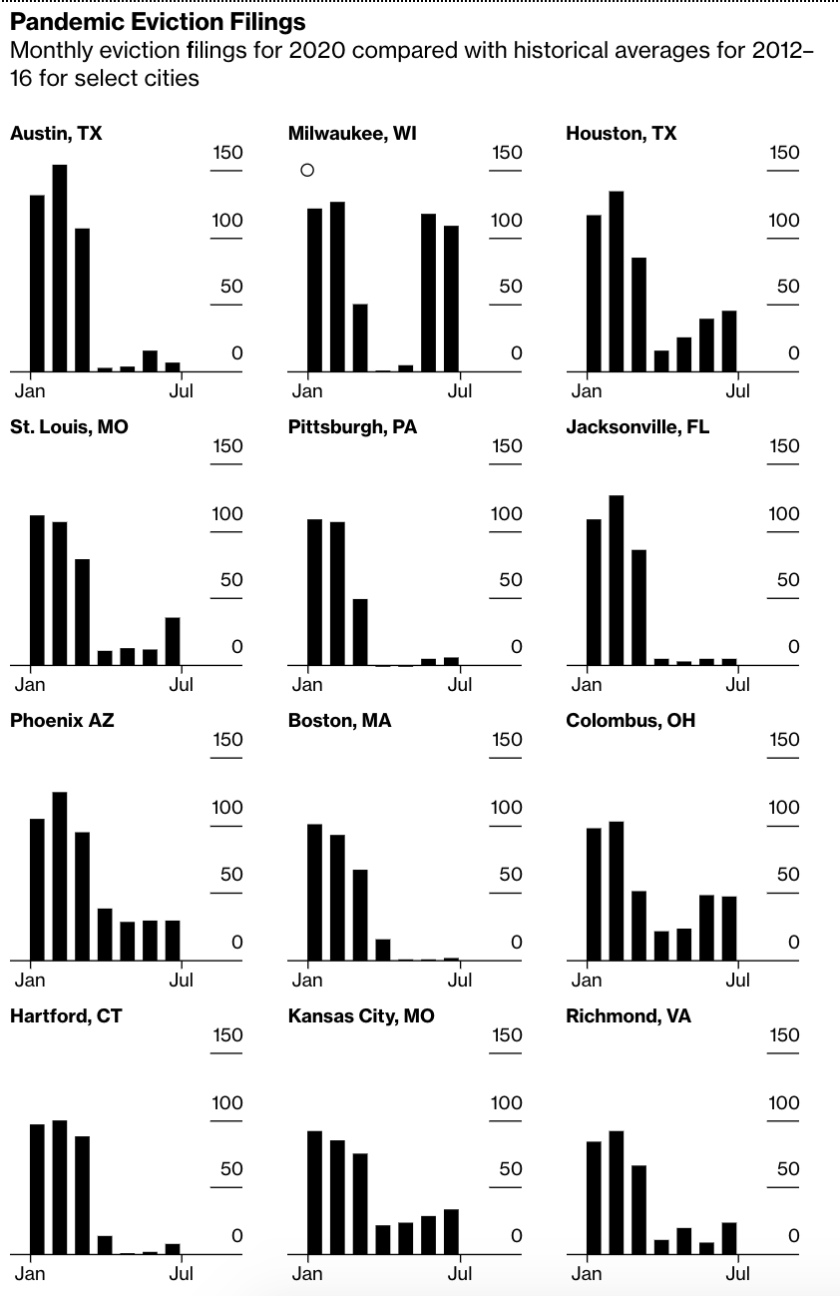

In June we reported that less than 8% of tenants were directly affected by COVID-19 in their ability to pay rent (read more here). According to research conducted by Bloomberg CityLab, we’re still not seeing data come in that suggest a big surge in evictions.

The COVID-19 Eviction Defense Project estimates that more than 29 million Americans in 13 million households could be at risk of eviction by the end of the year if conditions do not change. This estimate is based on the Census Bureau’s Household Pulse Survey and conservative assumptions about the acceleration of housing insecurity.

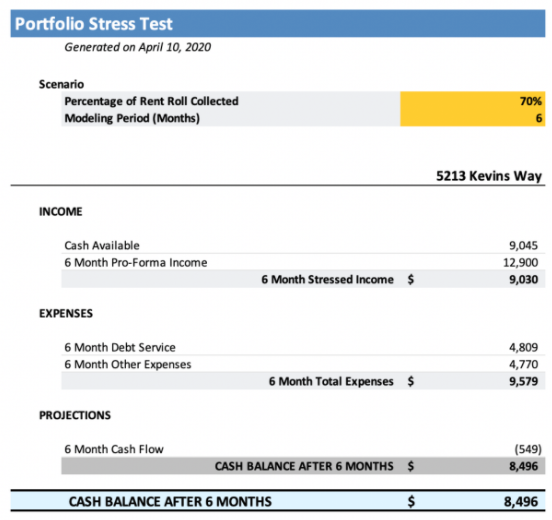

While some tenants are unable to pay their rent, it is important for landlords to understand how much financial runway they have. You can do this by conducting a stress test, or sensitivity analysis.

Here is an example for a 6 month outlook:

Stay informed and avoid evictions if you can

Different states and localities are providing resources to landlords and tenants and you should inform yourself on those initiatives. Follow the rules and help tenants who truly have the need to create a win-win solution.

Options include:

- Put a payment plan in place with a digital record to show the agreed upon amounts and dates they will be paid by (see an example here).

- As a landlord, if you are receiving late fee forgiveness for your mortgage payments, you may consider the same concessions with your tenants.

- Let tenants out of their lease early.

- Many states and localities have emergency rental assistance in place from funds disbursed through the CARES Act. Understand what resources are available to your tenants and point them in the right direction.

According to the Eviction Lab at Princeton University, Milwaukee is the only one of the 17 cities they track that has seen a return to its pre-pandemic baseline for evictions.

Drawing on tens of millions of records, the Eviction Lab has also published the first ever dataset of evictions in America, going back to 2000 on its website.

Current state of affairs in the COVID-19 crisis

Global Numbers

As of September 22nd, John Hopkins University of Medicine reports global COVID-19 cases at 31,453,048 and a mortality rate of 3.1% with 967,347 deaths.

Cumulative Worldwide Confirmed Cases

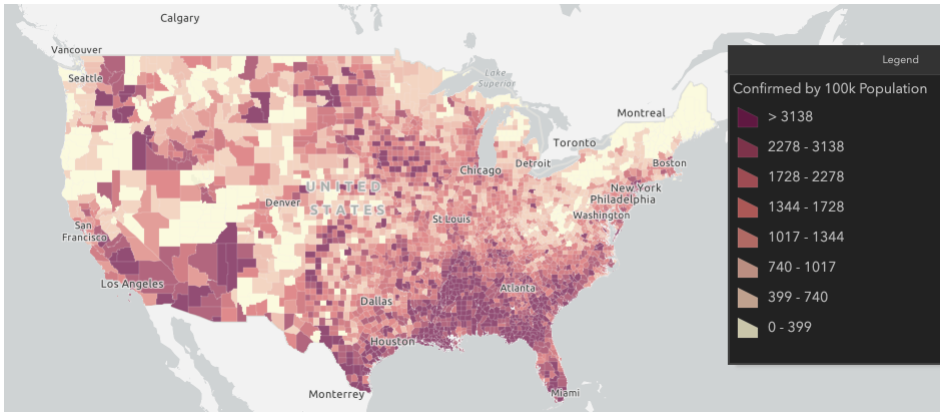

The numbers in our country are just as staggering with 6,889,086 reported cases and a milestone of 200,654 deaths to date -- a not much lower mortality rate than the Global average at 2.9%. Top hotspots include Los Angeles, Miami-Dade and Maricopa Counties, with very few localities not impacted to date.

US Cases by County

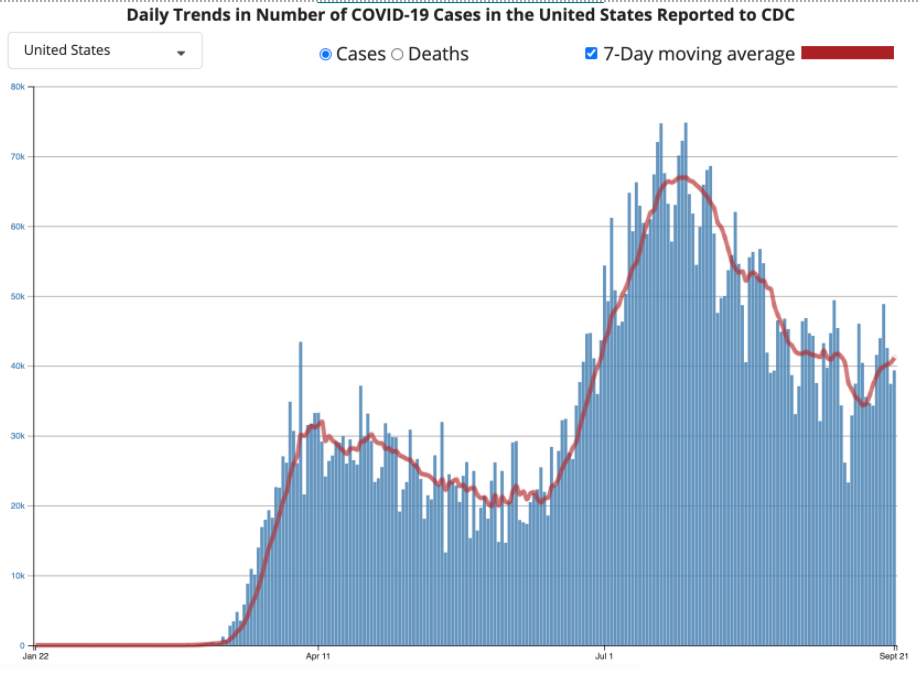

Daily cases have not sustained a downward trend from their peak on July 24th of 66,960. Daily cases of 41,141 as of Sept. 21 hardly means we are in the clear.

What do we know about COVID-19 and what can we do

We know that COVID-19 spreads easily through respiratory droplets, particularly when an infected person coughs, sneezes, or talks.

People without symptoms, called asymptomatic, can also spread the virus. Risk increases with age, as well as with underlying conditions, such as cancer, serious heart conditions, and diabetes. Severe illness can result in hospitalization, intensive care, a ventilator to help breathe, and death.

Health organizations around the world are recommending the following:

- Keep a safe distance. Physical distancing measures recommend 6 feet of separation, even if a person is not displaying symptoms.

- Clean your hands often. Use soap and water, or an alcohol-based hand rub.

- Wear a mask. When physical distancing is not possible, a mask helps to protect those around you.

- Stay home if you feel unwell. If you have a fever, cough and difficulty breathing, seek medical attention.

Resources

- Tenant Declaration Form

- CDC Emergency Eviction Order

- CDC resources

- John Hopkins Coronavirus Resource Center

- HUD resources, tools, and guidance available to respond to the COVID-19 pandemic, State and local officials

- Department of Treasury rental assistance programs

- The COVID-19 Eviction Defense Project

Get the Latest in Real Estate & Property Management!

I consent to receiving news, emails, and related marketing communications. I have read and agree with the privacy policy.