75% of Tenants Struggle with Rent Costs Nationwide

Inflation topped 8.6% in May, its highest since 1981. Property owners are feeling the pressure to increase rental rates while tenants continue to scramble to find ways to pay. Compared to last year at this time, annual rent increases ranged at the low end from around 15.3% (Apartment List’s National Rent Report) to the high end around 26.2% (Rent.’s Rent Report).

We spent the last 365 days hearing from 1k+ individuals to gain insight into the ever changing market. Our goal was to build empathy for how tenants and landlords are handling inflation, and changing rent. We also wanted to understand more how landlords feel about real estate as an asset class.

Rent increases by the numbers

Landlords feel confident their rentals hedge inflation but are not rushing to buy more properties

Nearly half of landlords with over a year in the business increased rent more than 3% this past year

48.7% of survey respondents, who have held their rental for over 12 months, told us they increased rent by greater than 3% this past year. The increases followed the federal eviction moratorium being lifted at the end of April last year, a hot housing market driven by low interest rates, extra savings, and shortages in housing. With inflation rates above 7% since the beginning of 2022 (U.S. Bureau of Labor Stats), we anticipate tenants to see annual lease renewals above 3% for the foreseeable future.

26.7% of the same cohort of landlords increased rental rates by a similar amount this year as in prior years, which is typically between 1% and 3% in years with normal inflation numbers.

Interestingly, a quarter of these respondents (24.6%) did not increase rents at all, despite general inflationary pressures. This could be due to continued uncertainty around state and local moratoriums, the desire to keep current tenants in place, or the simple fact that 44.9% of mortgaged residential properties were considered equity-rich in Q1 2022 (Attom).

Furthermore, smaller landlords are less likely to raise rents during the renewal period as vacancy has a larger short-term impact to them than what an institutional landlord experiences; for institutional landlords, vacancy is spread across a larger number of rentals.

Not all landlords use renewals as an opportunity to increase rents by an amount close to or at market rate. 12.4% of respondents let us know that they make it a general practice to rarely raise rents. Combined with locked in, low interest rates, the pressure to increase rents significantly may not have been felt by some of our respondents.

Does this differ substantially from the double digit rent increases we’re seeing in the broader market data? First, many of these increases are being reported through turnovers, where a tenant moves out and the landlord brings the rental back to market rate.

Furthermore, many of the rent increase numbers are being reported by large institutional investors and property management firms. While vacancy is costly for landlords, larger institutional investors (e.g. REITS) do not suffer as much in the short-term from vacancy as a smaller landlord who has two rental properties and loses 50% of their income in any given month when a rental is vacant.

For larger property management companies, they receive a percentage of the rental rate as their fee, and thus, it’s fair to say they prefer to increase rental rates or turnover the unit to get paid more through their leasing and management fees.

Rent increases were primarily driven by landlords wanting to have rental rates closer to the current market rate

Of the 154 landlords who have had a rental property for greater than one year, there were five main reasons to raise rental rates, many citing more than one.

The majority (67.5%) increased it to get closer to or at market rates. Closely behind were lease renewals (48%) and turnovers (32%). These three reasons had several overlaps as lots of things changed in the last 12 months.

Home improvements came in fourth, with 28% of respondents putting work into their rental properties this last year. In some jurisdictions, you cannot increase rent significantly without some capital investment, and this could have been a strategy used, or simply the fact that more people staying home for longer periods of time meant overlooked projects now needed to get done.

Finally, rising rents automatically increase the cost of traditional property management, with fees typically ranging from 8% and 10% of monthly rent. Unless you have a flat rate provider, like Hemlane, your margins on property management expenses don’t increase as rent increases. 23.4% of respondents cited increased property management expenses as a reason to increase rent.

Other landlords felt the need to pass along increased costs, including insurance, utilities, and property taxes (7.7%).

136 respondents entered the industry in the last 12 months are not included in these results.

Landlords still plan to hold on to their real estate assets

Regardless of years of experience in the business, 69.4% of respondents stated they are not planning to sell in the next 12 months. And the more experience you have, the less likely you plan to sell your rental properties compared to your cohort (74.4% of respondents with more than 5 years of experience versus 65.4% of respondents with less than 1 year).

Additionally, 9.5% of respondents are very likely to sell; 21.1% are somewhat likely to sell.

Of the many reasons provided, the largest factors that would influence a landlord’s sell decision to sell their rentals include include:

- Home appreciation

- Difficulty placing qualified tenants

- High property management costs

- Higher return in other non-real estate investments

- Increased home improvement costs

- Increased mortgage rate

- Increased condo fees

Of note, 6% of respondents made it clear to us that their investments would stay in real estate, and the reason to sell would be a better performing opportunity or a change in life circumstances.

Despite these reasons, there still remains high confidence in real estate as an investment. Almost half of respondents remain confident or extremely confident in their currently owned real estate investments protecting them from inflation. And, less than a third of landlords expressed that they may sell at least one of their rentals in the next twelve months.

Economic uncertainty means landlords are not rushing to purchase more rentals over the next 12 months

With interest rates rising, the jury is out on whether landlords will buy more rentals over the next 12 months. Over a third of respondents shared they are not likely to purchase, and just 11.6% are currently in the process of closing on a property, most likely taking advantage of locked in lower mortgage rates.

Landlords also shared they are not planning to scale up their investments. Where 38.2% of surveyed landlords purchased a rental property in the last 12 months, a resounding 67.9% of landlords surveyed do not plan to purchase more rental properties this year compared to last.

Comparing this information to survey responses on likelihood to sell, this seems to indicate there is equal willingness to sell or acquire rental properties, depending on where the market goes.

Three quarters of tenants are cost burdened by rent with nearly half citing that rent this year is taking a larger share of monthly expenses

68.5% of tenants reported a rent increase and 74.8% now spend more than a 30% of their income on housing

Regardless if you moved the last 12 months, as a tenant, you are feeling the pain of rent increases. 68.5% of survey respondents recorded an increase and this was almost evenly split between those who moved (48.5%) and those who didn’t (51.5%).

74.8% of respondents also shared that they now spend more than 30% of their income on housing costs. This continues to put the squeeze on renters as rent to income ratios go up and increasingly exceed the recommendation of the United States Department of Housing and Urban Development (also known as HUD) to spend a maximum of one third of one’s income on housing.

And income increases are not keeping up with rent increases

U.S. wages increased 12% in April 2022, compared to the same month last year. As previously mentioned, May saw an 8.6% increase in inflation, and 15.3% to 26.2% increases in rent. One can do simple napkin math to see that these numbers won’t continue to be sustainable.

54% of tenants confirmed that rent is now taking a larger share of monthly expenses, compared to last year. 68.5% also confirmed that their rent has gone up.

Here are the main reasons cited for increases:

- Rent increases in general

- Moved to a more expensive area

- Chose not to live with roommates/family

- Moved to a home with more amenities

7% of respondents took the following actions to help reduce their rent to income burden:

- Moved to a cheaper area

- Moved to a place with cheaper amenities

- Added roommates

- Moved in with family

25% also reported that their rent has stayed the same with seven out of ten of those respondents staying put in the same property.

The income to rent ratio is an important metric for landlords to track where a tenant would ideally make three times their monthly rent

Jay Parsons from RealPage recently reported that incomes of new market-rate leases in May reached $77,000, an 8% increase year-over-year. That would cover a monthly rent of $2,140.

However, the US Department of Labor reported median weekly earnings in the first quarter of this year that work out to roughly $53,924 annually which would cover monthly rent of less than $1,500.

According to Bloomberg, even renters making $250,000 annual salaries have shared they are living month to month, spending nearly all of their income on household expenses. This is especially the case with Class A and Class B properties.

Landlords need to understand what a good income would be when setting their rental rates, and also take into consideration savings and credit scores when making their final decision.

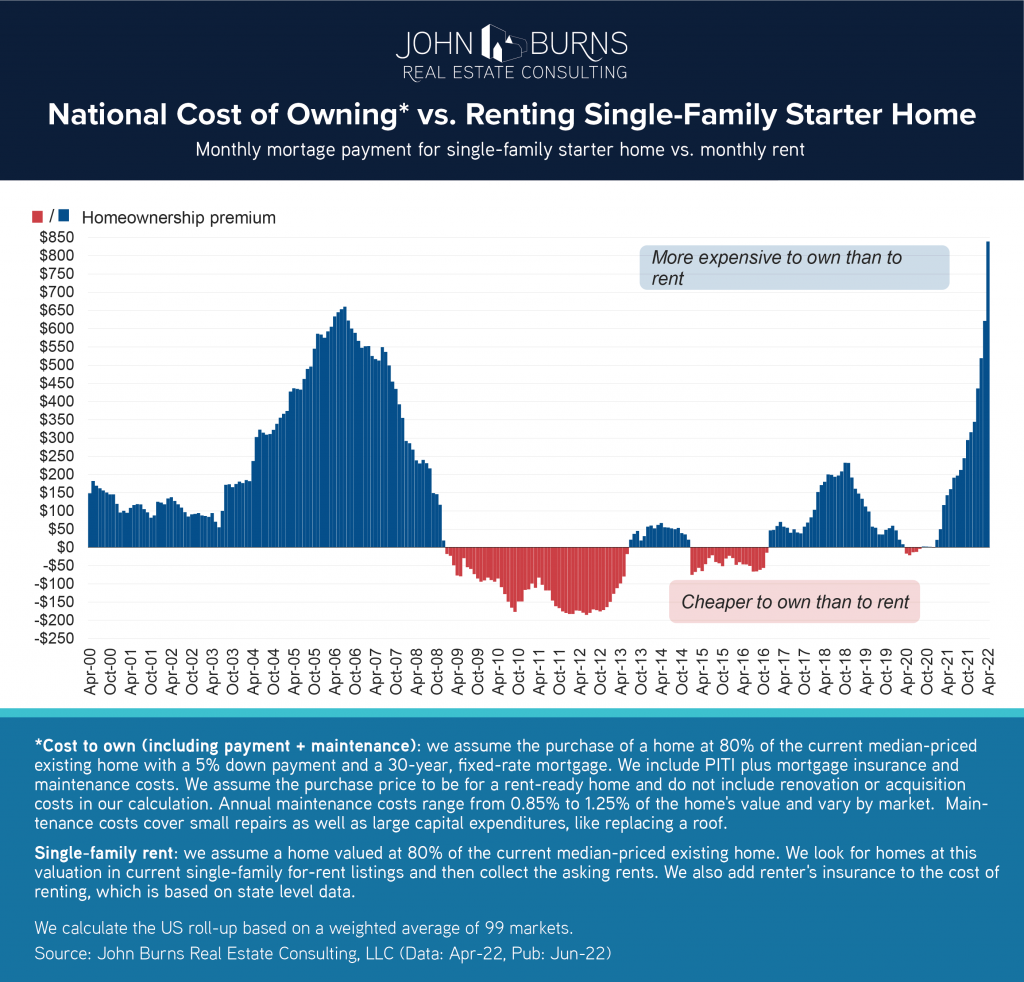

With increasing housing costs, it’s still better to rent than own in 45 of America’s 50 largest cities

The Price-to-rent ratio helps us determine if conditions are favorable for buying a home, or to continue renting, with 1 to 15 being more favorable to buy, and 16+ favorable to rent. According to a 2021 review of the 50 largest cities in the US by SmartAsset, only 5 cities were more favorable to buy in: Baltimore, Detroit, Cleveland, Philadelphia, and Milwaukee.

It seems that for many looking to own their first home, it is actually cheaper to continue renting for the time being.

Conclusion

This survey was intended to better understand how residential landlords and tenants have been impacted the last 12 months. Responses confirm that rents are going up, and tenants are increasingly spending more of their income to support housing costs.

Investors remain confident in their existing real estate investments, however, do not plan to increase their portfolio size over the next 12 months. This supports the sentiment that the real estate market is not crashing and that real estate investments are a buffer from inflation.

Our advice is that landlords and property managers should continue to encourage great tenants to stay long-term in their rental properties. We also recommend that landlords and property managers keep housing affordability top of mind, especially with rising interest rates and increasing cost burdens for tenants.

Remember that consistent and steady cash flow AND providing a place to call home do not have to be opposing objectives.

Data disclaimer:

This survey was conducted in June 2022 with 327 Hemlane landlords and 746 tenants. The margin of error for landlords is +-2.36% The margin of error for tenants is +-3.44%.

Get the Latest in Real Estate & Property Management!

I consent to receiving news, emails, and related marketing communications. I have read and agree with the privacy policy.