Investor Questions: Joint tenants vs tenants in common [+ FAQs]

When people purchase real estate together one of the most important questions to answer is how to hold title. While both joint tenancy and tenancy in common allow more than one person to have an ownership interest in real estate, there are distinct pros and cons to each.

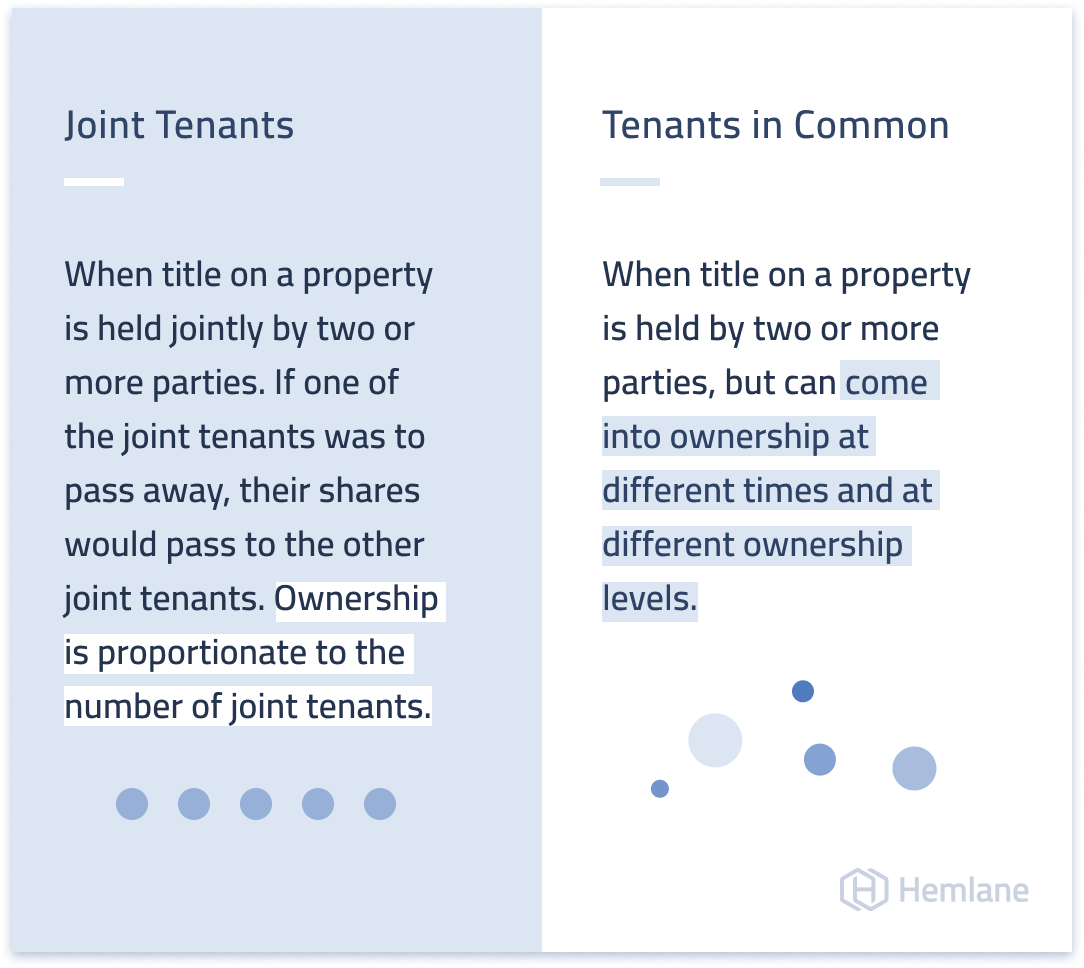

- Joint Tenants: When title on a property is held jointly by two or more parties.If one of the joint tenants was to pass away, their shares would pass to the other joint tenants. Ownership is proportionate to the number of joint tenants.

- Tenants in Common: When title on a property is held by two or more parties, but can come into ownership at different times and at different ownership levels.

For the purposes of joint tenants and tenants in common, the word ‘tenants’ refers to the owner, and not someone who rents the property. Whether you’re a remote investor, or a hands-on property manager, you need to understand the distinction.

In this article, we’ll explain the difference between these two forms of real estate ownership, then answer some of the most frequently asked questions investors have about joint tenants vs. tenants in common.

Joint Tenants

Under a joint tenancy (JT), the property is owned equally along with whoever else is buying it. This means that regardless of the number of people who invest in a property as joint tenants, each person owns 100% of the property with no divided interest.

Tenants in Common

When a property is owned with others as tenants in common (TIC), each owner or co-tenant has a percentage (or divided) interest in the real estate. For example, imagine that three investors purchase a $100,000 property as tenants in common. If the first investor puts up $50,000 and the remaining two put up $25,000 each, the first investor owns 50% of the property as a tenant in common and the other two investors each own a 25% interest.

Joint Tenants vs Tenants in Common FAQs

Here are some of the most frequently asked questions by investors about joint tenants and tenants in common:

Q: How easy is it to buy a property?

Joint tenants must take title to the property simultaneously, while tenants in common can buy an ownership interest at different times. This means that the number of co-tenants (owners) can change and that different percentages of ownership are possible.

Taking title to the property is easier under a joint tenancy, with terms of ownership outlined in the deed. On the other hand, taking title as tenants in common frequently requires an additional document, such as an operating agreement for an LLC of a Deed of Trust.

Q: How easy is it to sell a property?

Although buying property as tenants in common can be more complicated, selling is usually easier. A tenant’s ownership interest can be bought and sold without the consent of the other owners, unless specified in an operating agreement. The drawback is that the remaining owners may end up with a new co-tenant that they know nothing about.

A joint tenant cannot sell its interest in the property since all parties own 100% of the property. Instead, each joint tenant must agree to the terms and conditions of a sales contract.

Q: How are sale proceeds distributed when the property is sold?

Sales proceeds in a joint tenancy are distributed equally since each joint tenant has the same equal interest in the property. With tenants in common, the sales proceeds are normally distributed based on the percentage share in the property that each co-tenant holds.

Q: What happens with the right of survivorship?

The right of survivorship is the right given to another person to inherit property on an owner’s death. Under joint tenancy, if one owner passes away the surviving joint tenant(s) becomes the owner of the deceased owner’s share of the property.

By contrast, tenants in common have no right to survivorship. Unless the deceased’s will specifically states that their interest in the property will be divided among the surviving owners, the interest of the deceased as a tenant in common belongs to the estate.

Q: How do debt and property taxes work?

All tenants are equally liable for debt and taxes under both joint tenancy and tenants in common.

When a property is financed as tenants in common, each owner typically signs the loan documents. In the case of default, each owner may be held individually liable for the debt even though they own less than 100% of the property.

This also means that if one tenant in common stops making contributions to the mortgage payment, the other co-tenants must make the payment in full to avoid default and potential foreclosure.

Property taxes work in a similar way.

Although a tenancy in common agreement divides ownership interest in the property, most taxing authorities will not divide a parcel of land and create an individual tax bill based on each tenant’s percentage of ownership. Generally speaking, each tenant in common is jointly and severally liable for property taxes up to the full amount of the tax assessment.

Q: Which tenancy type is the better option for real estate investors?

In most cases, tenants in common may be the better option for real estate investors who are acquiring properties with other individuals, other than their spouses or family members.

Property can be purchased faster if one owner has more income or capital than the other members. The flexibility of tenants in common also allows different percentages of ownership, and for the number of tenants to change throughout the holding period of the investment. Generally speaking, there is no limit to the number of tenants in common, although a property can not have more than 35 owners if 1031 exchange eligibility is wanted.

Although ownership percentages under a tenants in common structure are normally based on what each owner has put into the property, the co-tenants can agree to a different ownership share. For example, one co-tenant may contribute less capital in exchange for day-to-day management responsibilities and a greater percentage of ownership.

Tenants in common ownership also makes it easier for each owner to dispose of their share of the investment by selling the share to another investor. When this occurs, the remaining tenants may own the property with a new co-tenant with whom they disagree or dislike.

This is why it’s critical to have a lawyer review all your agreements to ensure that you and your other co-tenants are protected under your particular jurisdiction’s legal parameters around tenants in common. Further, choosing the right partners to invest with in the beginning is also important to maintain good relationships and avoid costly litigation. When relationships fail, as some do, having the right lawyer on your team to structure and set expectations for situations that can be highly emotional is critical.

Conclusion

When you invest in real estate with someone else, one of the biggest decisions to make is whether the property is owned as joint tenants or tenants in common.

Choosing one form of ownership over the other depends on a number of factors, including your individual investment goals and objectives, who you are investing with, and how much control you wish to have over your share of ownership.

Get the Latest in Real Estate & Property Management!

I consent to receiving news, emails, and related marketing communications. I have read and agree with the privacy policy.