Calculating Cash on Cash Returns (2023 Guide)

Of all the financial calculations a real estate investor can make, the cash on cash return formula is one of the most useful for rental property investors focused on cash flow. At the end of the day, your ROI as an investor depends on two things, how much money you put in a deal, and how much it gives you back. The cash on cash return formula will give that to you.

metrics are particularly important for remote property managers who rely on numbers rather than a physical presence to stay on top of their portfolios.

In this article, we’ll explain how to calculate cash on cash return, what a good cash on cash return is, and why the cash on cash return formula matters so much to real estate investors in 2021.

What is cash on cash return?

Cash on cash return measures the amount of money you earn compared to the capital you invest.

A simple example of cash on cash return is a Certificate of Deposit (CD) from your local bank or credit union. According to Bankrate, the interest rate on a 5-year CD is about 1.0%. So if you deposit $25,000 in a CD your cash on cash return would be $250 ($25,000 x 1%).

As you probably know, rental property can generate returns much greater than 1%, although calculating the cash on cash return for investment real estate is a little more complex.

How to calculate real estate cash on cash return

Let’s take a look at the basic steps to follow to calculate the cash on cash return for real estate investment assets.

We’ll assume you purchased a $100,000 house using a conservative down payment of $20,000. Your gross rental income is $1,100 per month, your operating expenses are $550 per month (utilities, lawn care, etc.), and your mortgage payment is $345 per month (principal and interest).

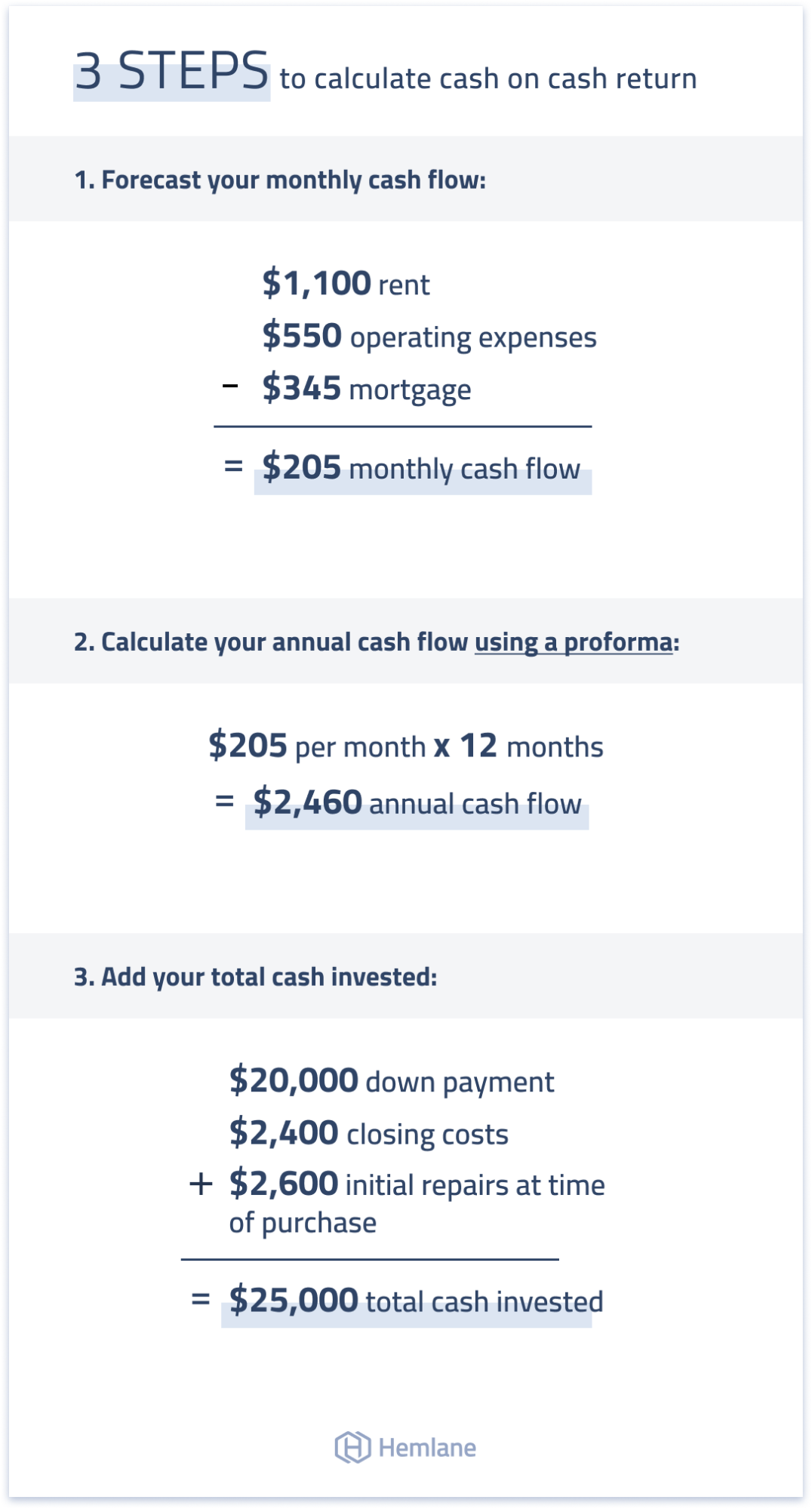

3 steps to calculate cash on cash return

1. Forecast your monthly cash flow: $1,100 rent - $550 operating expenses - $345 mortgage = $205 monthly cash flow

2. Calculate your annual cash flow using a proforma: $205 per month x 12 months = $2,460 annual cash flow

3. Add your total cash invested: $20,000 down payment + $2,400 closing costs + $2,600 initial repairs at time of purchase = $25,000 total cash invested

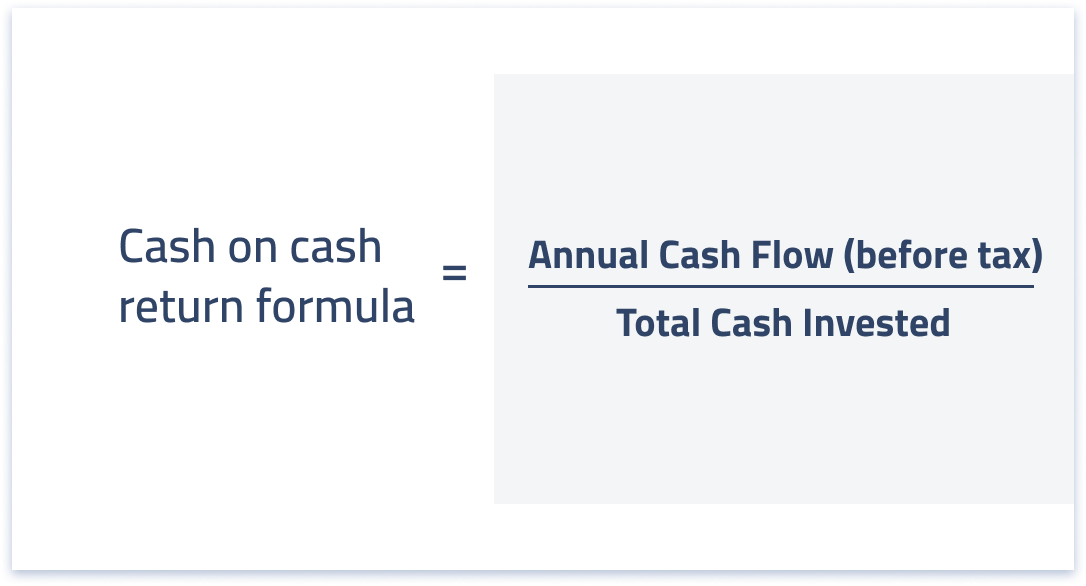

Cash on cash return formula

The cash-on-cash return formula for real estate is easy to use once you have all your inputs. Simply divide your annual cash flow by the amount of cash invested:

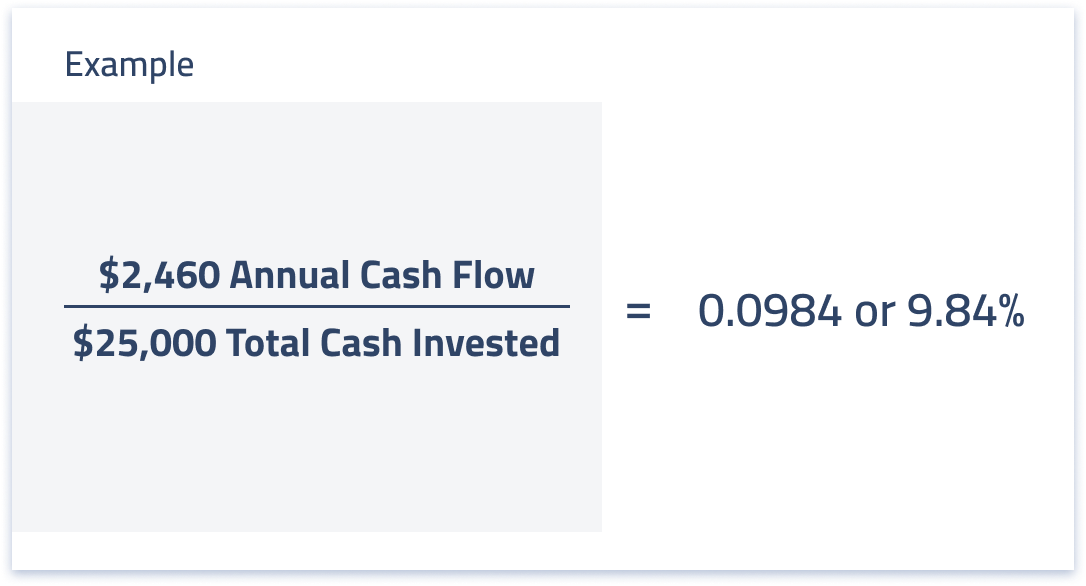

- Cash on Cash Return = Annual cash flow (before income tax) / Total cash invested

- Example: $2,460 Annual Cash Flow / $25,000 Total Cash Invested = .0984 or 9.84%

This means that after one year, nearly 10% of the money you invested in the property has been returned.

After a little more than 10 years, the rental property will have paid back your entire capital invested (assuming rents and expenses remain unchanged) which is why buy-and-hold real estate investors like the cash on cash return calculation.

What is a good cash on cash return?

Compared to a CD paying 1% per year, the 9.84% return from the rental property looks pretty good. But comparing a CD to real estate really isn’t a fair comparison because we’re not comparing apples to apples. And, keep in mind inflation will eat at your cash-on-cash returns as well.

CDs from an FDIC-insured bank have virtually no risk, while even the best investment real estate always has a certain amount of calculated risk. One of the reasons the cash on cash return from real estate is higher is to compensate an investor for taking the additional risk.

Cash on cash return is most useful when comparing one rental property investment to another one that is similar. Generally speaking, the property that generates the highest cash on cash return will be the best choice, everything else being equal.

However, factors such as the age of the home, neighborhood and school district rankings, and overall desirability of the area can affect your cash on cash return.

For example, properties in older neighborhoods may have a higher cash on cash return compared to newer and more desirable neighborhoods. But, there can also be more headaches involved managing the tenants, filling vacancies, maintaining an older property, and raising the rents, creating potentially more risk.

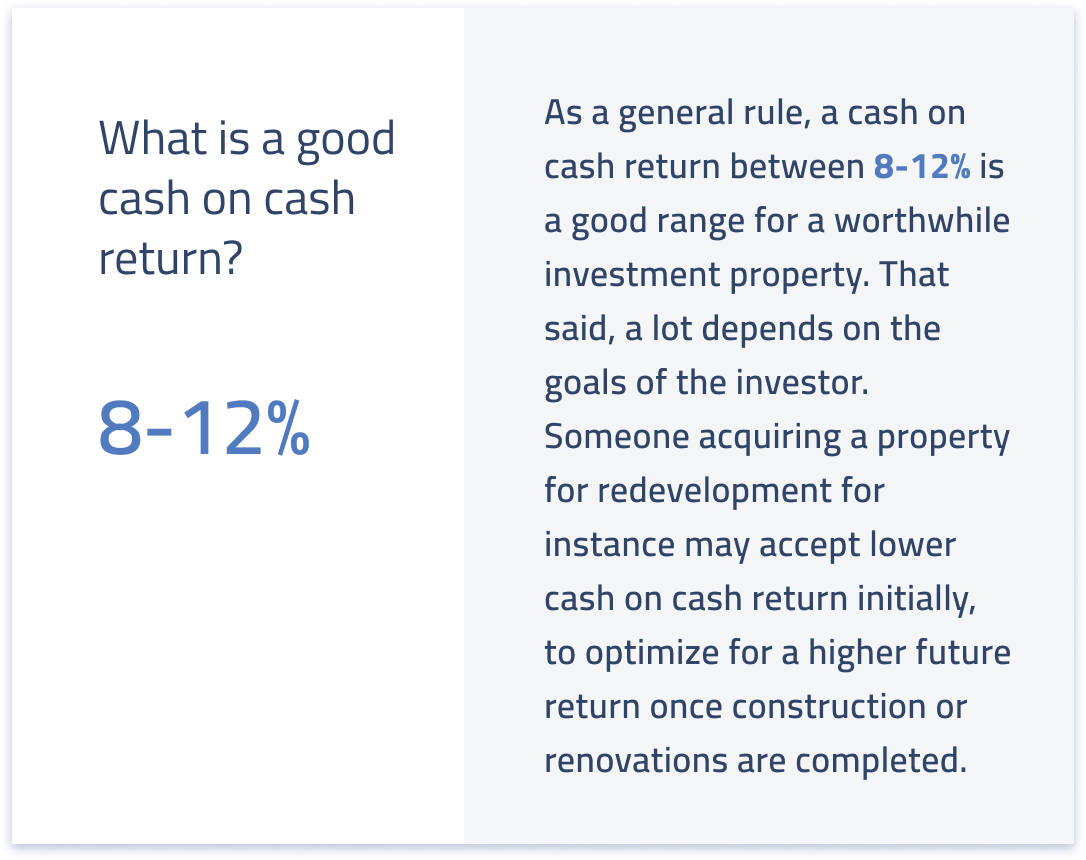

Pro Tip: As a general rule, a cash on cash return between 8-12% is a good range for a worthwhile investment property. That said, a lot depends on the goals of the investor. Someone acquiring a property for redevelopment for instance may accept lower cash on cash return initially, to optimize for a higher future return once construction or renovations are completed.

Why do we exclude taxes in cash on cash returns? Everyone’s tax situation is different, so excluding taxes allows for a more accurate calculation.

Drawbacks to the cash on cash return calculation

Cash on cash return is a simple formula that’s quick and easy to calculate when comparing different investment opportunities. Because most investors buy a rental property for the positive cash flow, the cash on cash calculation is also a good way to predict how quickly your passive income will grow.

Despite the positives, there are some drawbacks to the cash on cash return calculation:

- Does not consider long-term appreciation of the property.

- Not useful for wholesale real estate or distressed property investing if the property is assigned or flipped.

- Cash on cash return is less important for value-add investments because the value is created through the renovation and not the cash flow generated.

- Risk is not taken into account with the cash on cash return calculation.

- Buyer beware: sellers can make a property’s cash on cash return appear better than it really is by increasing leverage.

Cash on cash return vs other metrics

In addition to cash on cash return, successful real estate investors use other financial metrics to analyze the potential financial performance and future value of an investment property:

Gross rent multiplier

The gross rent multiplier (GRM) divides the fair market value of a home by the gross rental income:

- GRM = Price / Gross Annual Rent

- $100,000 Price / $13,200 Gross Annual Rent = 7.57 GRM

Everything else being equal, the lower the GRM is the more attractive the investment property could be. Typically, an average GRM is 4 - 7.

Rent vs cost

The rent versus cost calculation compares the monthly rent to the total property purchase price, including repairs, and is best used when comparing similar single-family homes or small multifamily properties:

- Monthly Rent / (Purchase Price + Initial Repairs)

- $1,100 Monthly Rent / ($105,000 Purchase Price + Closing Costs and Initial Repairs) = .0105 or 1.05%

Cash flow investors generally look for a rent vs cost ratio of at least 1% or more.

Capitalization rate

The cap rate calculation compares a property’s annual net operating income (NOI) to the property purchase price. Note that NOI does not include the monthly mortgage payment, only normal operating expenses:

- Cap Rate = NOI / Purchase Price + Closing Costs and Initial Repairs)

- $6,600 NOI / ($105,000 Purchase Price + Closing Costs and Initial Repairs) = 0.063 or 6.3%

Cap rates should only be used when comparing like-kind property in the same area to one another. For example, 3% could be a great cap rate for a rental property in San Francisco, while an investor in Charlotte would expect a cap rate of at least 6%, if not more.

Return on investment

Return on investment (ROI) calculates the return of your investment over the entire holding period, including the appreciation in property value.

Using our $100,000 home as an example, let’s assume that after five years you sell the property for $128,000. The total cash flow over five years was $12,300, and your total investment in the property was $25,000 (including the down payment, closing costs, and repair costs):

- ROI = (Gain on Investment – Cost of Investment) / Cost of Investment

- [$40,300 Gain on Investment ($28,000 from appreciation + $12,300 Cash Flow) - $25,000 Cost of Investment] / $25,000 Cost of Investment = .612 or 61.2% over the five year holding period

Note that this simple example doesn’t take into account items such as rental increases, rental income lost to vacancy between tenant turns, and any capital repairs required above and beyond normal maintenance.

Internal rate of return

Internal rate of return (IRR) is a powerful formula used to calculate the financial performance of investment real estate.

By using an online IRR calculator you can easily calculate the internal rate of return of a real estate investment:

- Initial Investment = $25,000

- Period 1 Cash Flow = $2,460

- Period 2 Cash Flow = $2,460

- Period 3 Cash Flow = $2,460

- Period 4 Cash Flow = $2,460

- Period 5 Cash Flow = $30,600 (cash flow + gain from sale)

- IRR = 11.824%

Why is the IRR so much lower than the ROI?

It’s because IRR takes into account important factors such as the variability of cash flows and the time value of money. While ROI considers only the amount of money going in and coming out of a property, IRR considers when the amount of money goes in and out.

Final thoughts on cash on cash return

Cash on cash return is a quick and easy way of calculating the potential financial performance of income-producing real estate. All you need to know is your gross rental income, operating expenses, and mortgage expense to calculate cash on cash return.

However, the cash on cash return formula doesn’t take into account other important factors such as property appreciation, the time value of money, and when the money is received.

That’s why experienced real estate investors use cash on cash return along with other metrics to predict the future performance of real estate investments.

Get the Latest in Real Estate & Property Management!

I consent to receiving news, emails, and related marketing communications. I have read and agree with the privacy policy.