The 3 Fastest Steps to Understanding a Tenant’s Credit

The credit report provides a prospective tenant’s likihood to pay, using past bills as a primary indictor. According to a TransUnion survey, a tenant's ability to pay rent is a concern for rental owners. In fact, 84% of landlords said rent payments were their top concern. Considering the effort and cost associated with evictions, understanding credit reports is crucial before accepting a new resident. This article summarizes how to read a tenant’s credit report and how to proceed with the information. You will learn the intricacies of the report but most importantly, you’ll find the fastest way to read a tenant’s credit report.

STEP 1: When to request the credit report

Denied applicants may claim “you discriminated against me” when you do not select them. Believe me, it’s even worse when you have a tenant who paid for the credit and background check and still got denied. How do you mitigate this risk?

The best time to pull their credit report is AFTER you review their application. At this point, you will know:

- Income and other assets - Do they have enough money to pay each month and is their income stable enough? Liquid assets in their bank account is also important.

- Other application information - For example, do they have a pitbull and your insurance does not allow pitbulls? Read more about Tenants with Animals here.

When a tenant does not pay as much for the application, or you make the application free, they are less likely to get upset when you deny their application due to objective qualifications not being met.

Pulling a tenant’s credit is highly recommended once their application has been reviewed. Waiting until the application is complete can save time and money by eliminating unqualified applicants early in the process. If the application has any red flags, it’s not worth taking them to the next step in the process. See our applicant screening article for more details.

STEP 2: Read the high level details in 30 seconds

As you look at the actual report, there are a few sections. Below you will find the #1 thing to look for in each section:

- Personal information: Verify their address and employment matches the application.

- Fraud indicators: Confirm there are none.

- Profile summary: Confirm there are no tradelines with negative history or any outstanding, past due payments.

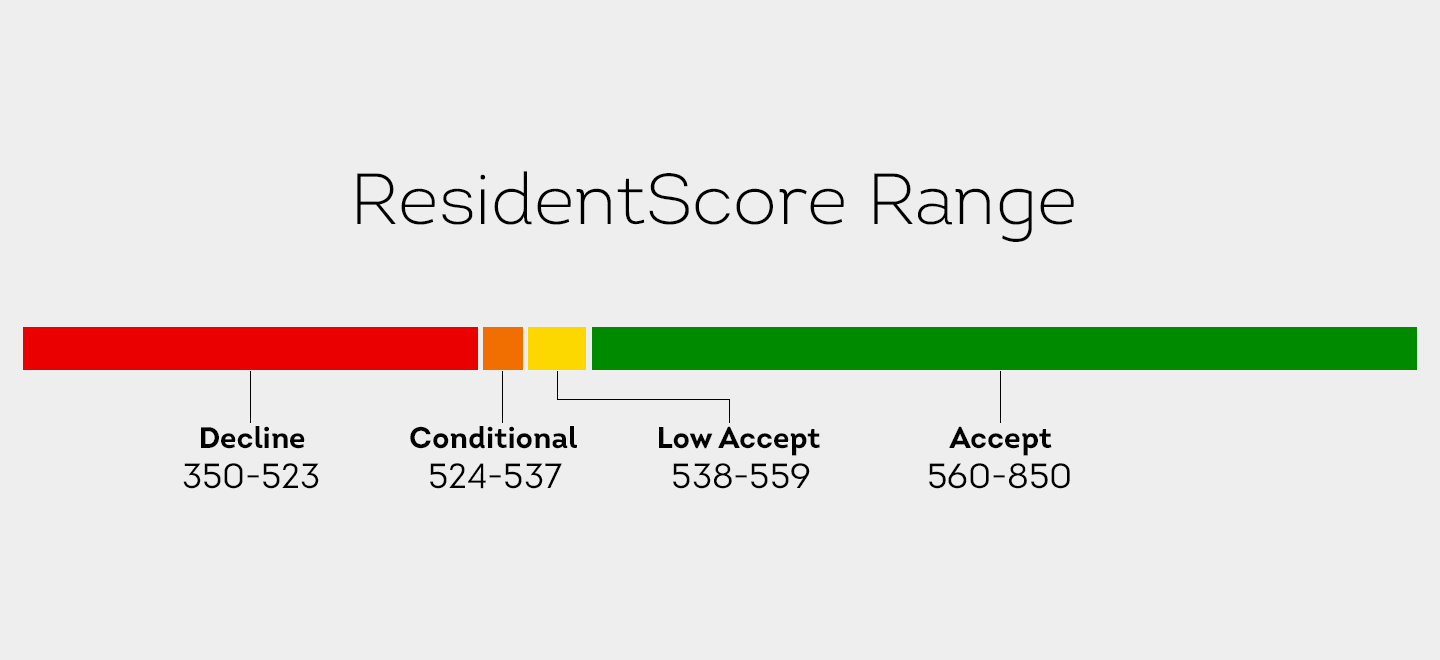

- ResidentScore: Ensure this is over at least 524 (more information in the below section).

- Collections: There should not be anything out for collection. If so, who is collection agency?

- Inquiries: Do they have a lot of recent inquiries, potentially signaling that credit card companies or other rental agencies are denying them?

If you only read one thing, what should it be?

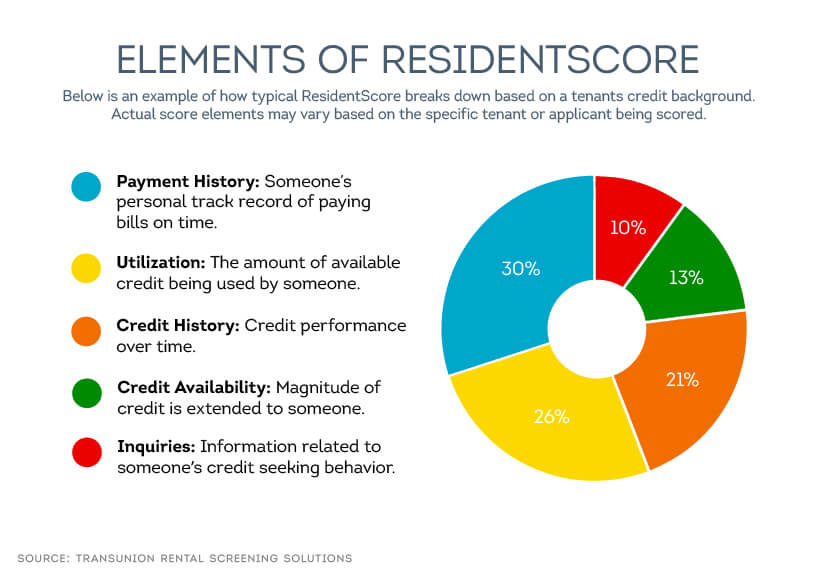

The credit score itself measures the reliability of the applicant and is the most important metric in the report. TransUnion’s ResidentScore is probably the most accurate credit score, since it is specific for rental properties. The ResidentScore is based on the same elements of a traditional credit report, but with the weight of each component specific to the ability to pay rent. According to TransUnion Rental Screening Solutions analysis, 24% of residential property rentals have bad outcomes. This data is factored into the formulation of a ResidentScore. Red flags for tenants that are not accepted include: Evictions, 3+ late payments, and/or insufficient funds.

If an applicant has a high score and zero debt, it safe to say you can proceed. Below, you will find the ResidentScore range, illustrating what scores are typically acceptable.

STEP 3: Dive into the details

While you can get a really good idea on the tenant’s financial strength from Step 2, the devil is in the details.

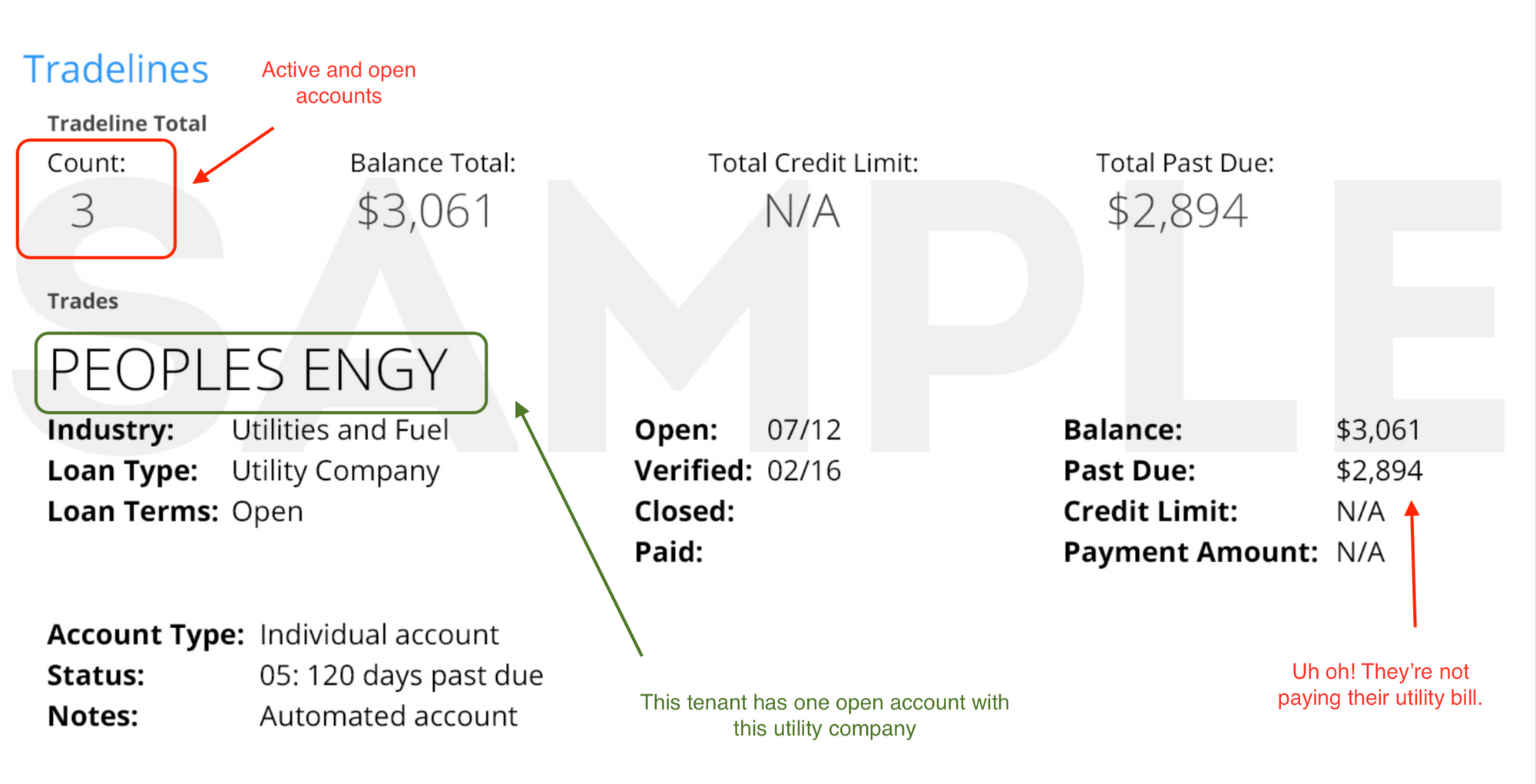

What the heck is a tradeline?

A tradeline is an account reported to a credit agency. To put this in layman’s terms, it is a summary of your credit accounts. For example, you go to Banana Republic and open a credit card to get the 15 percent discount. This a a tradeline.

Tradeline includes items sucha as a mortgage or credit card, and it will indicate the number of payments and activity. Tradelines provide insight into how financially sound an applicant is.

Scroll down from the tradelines section and you’ll be able to see the active ones:

Tradelines are important because they can be different. An applicant with debt due to medical bills is different than someone who has accumulated debt at Nordstrom. Although they could have the same amount of debt, these are two entirely different tenants. Try and give a second glance at the type of debt that the applicant has. Be aware of what the outstanding accounts are and recognize trouble when you see it.

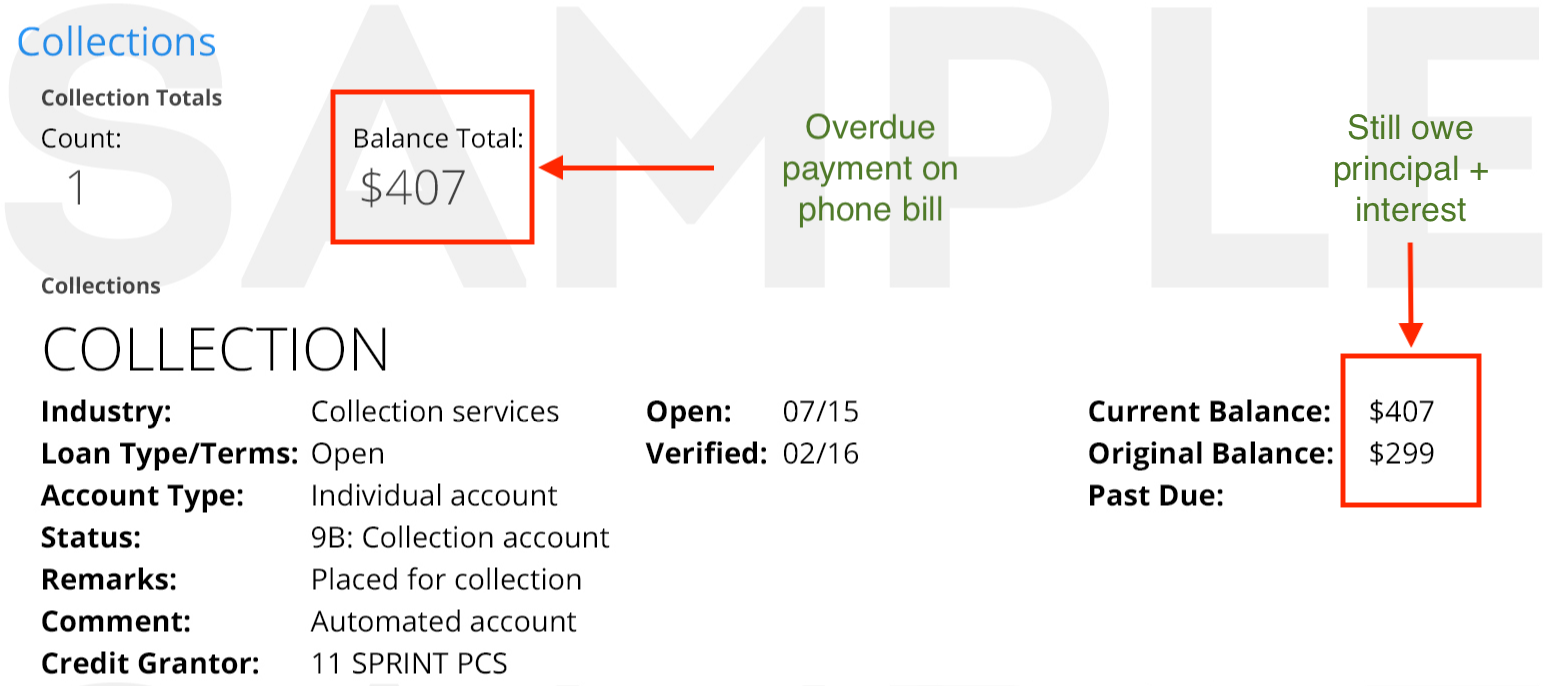

What does it mean when something is in collection?

A collection is when the tenant has not paid their debt. This can significantly lower their credit score. Several accounts out for collection denotes an increased likelihood of an unreliable applicant.

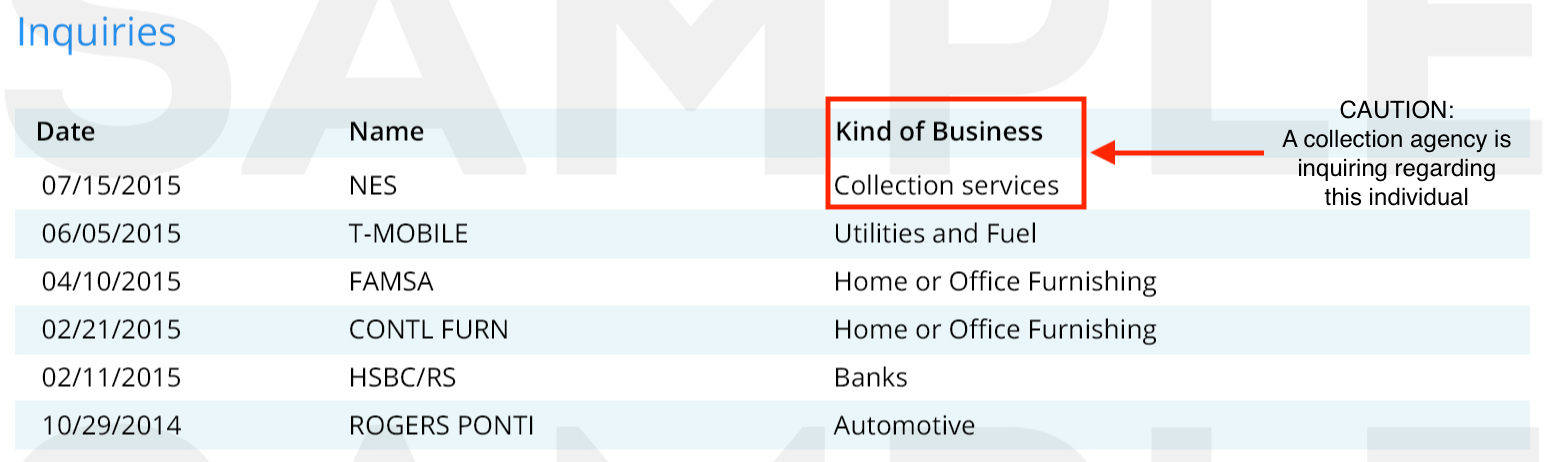

What are inquiries?

Inquiries show who else is looking at the applicant’s credit. In other words, has their report been pulled for a new automobile loan or a new credit card? And, if they have been applying to many rentals and getting rejected, you will see inquiries from background check screening companies.

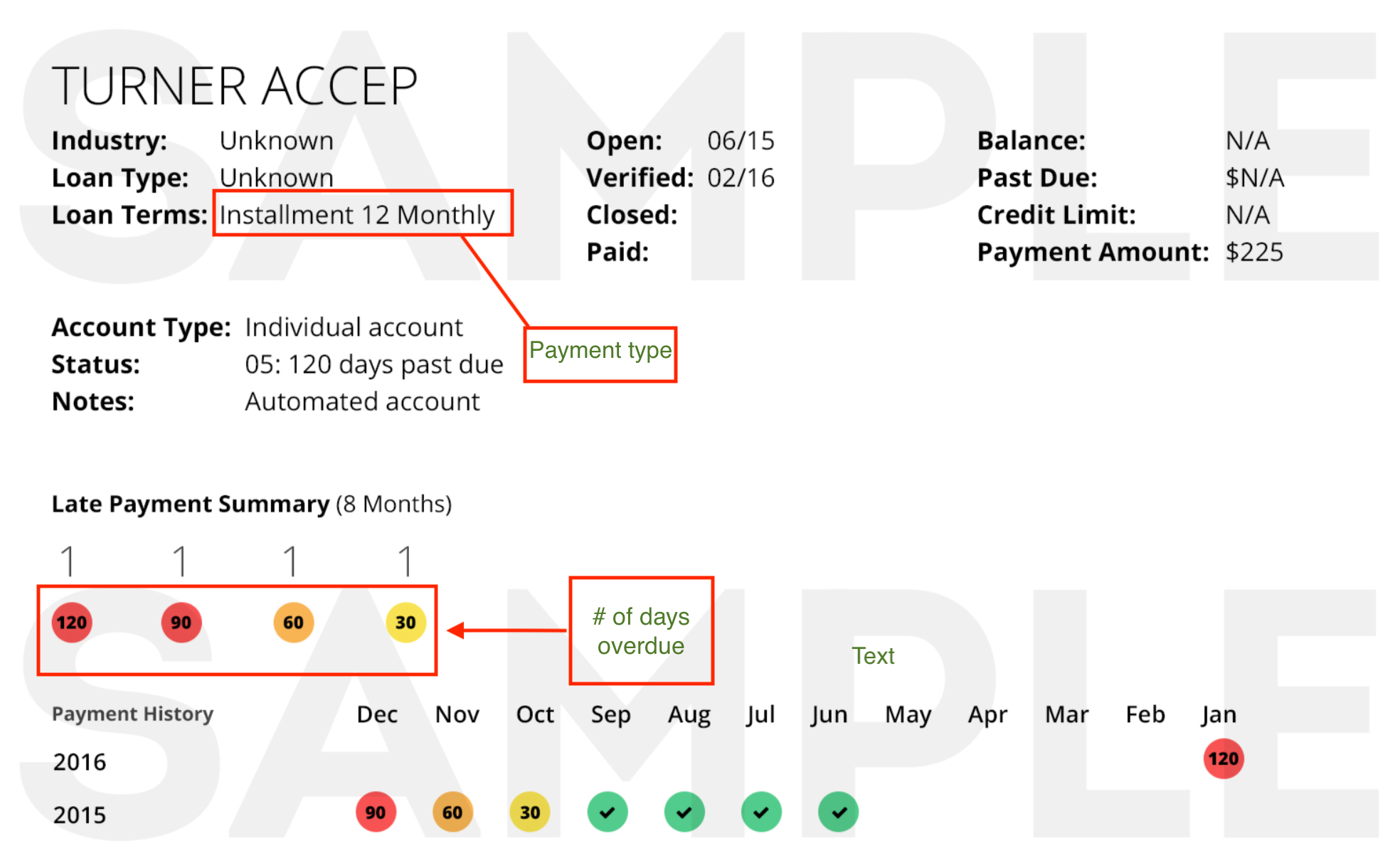

Tell me about the days overdue?

Below you can see this applicant has been late on their payment for over 120 days. The circles indicate the number of days overdue.

Is no credit equal to bad credit?

Not really. I would rather take someone with no credit than bad credit, as long as the applicant without credit can prove they are financially stable. Tenants with no credit could still be good tenants if you look at the greater picture. Perhaps the tenant pays all of their bills via cash and has no debt. Or, perhaps they are a recent graduate from a top university and are just starting to build credit. Bad credit, on the other hand, shows that the person has a poor track record of making payments on time.

Can I accept a tenant with bad credit?

When you want to accept a tenant who does not meet your criteria, ask for a co-signer (guarantor) or a higher security deposit. A co-signer will be financially responsible during the duration of the lease (and will have to sign the lease). A court case can even provide the landlord authorization to garnish wages from a co-signer if the tenant is late on rent. And, a higher security deposit can cover the increased risk of an eviction.

Summary: Is credit really necessary with tenants?

Credit is a strong and systematic way to understand a tenant’s ability to pay bills. You may decide to select a tenant with no or low credit, but you should always pull the credit report to understand the applicant's financial situation before offering a lease to the tenant.

Furthermore, a comprehensive screening process, which includes evictions and criminal history, will provide more data points on the applicant. As a landlord or manager, you should be knowledgable on a tenant's background. With the power of today’s technology, there are systems and processes that can do this work for you.

You may realize that the process is different for each rental property and tenant. Keep in mind that the class of the property (Class A to Class D) may dictate the screening requirements. Class A rentals are the highest quality and therefore require a higher credit score. On the opposite spectrum, Class D rentals, you may have to settle for little or no credit. And, the reason for a tenant’s low credit score may vary based on factors such as the type of debt and the age of their credit.

If you take one thing away from this article, it is to have full transparency on your applicant. With low or no credit, you should still feel comfortable with understanding why and what precautions you can take to mitigate risk. After the credit report, make sure to perform a full comprehensive background check. You can read more about the full application and screening process here.

Additional bonus from TransUnion: 6 Rental Trends that Landlords May Face

Get the Latest in Real Estate & Property Management!

I consent to receiving news, emails, and related marketing communications. I have read and agree with the privacy policy.